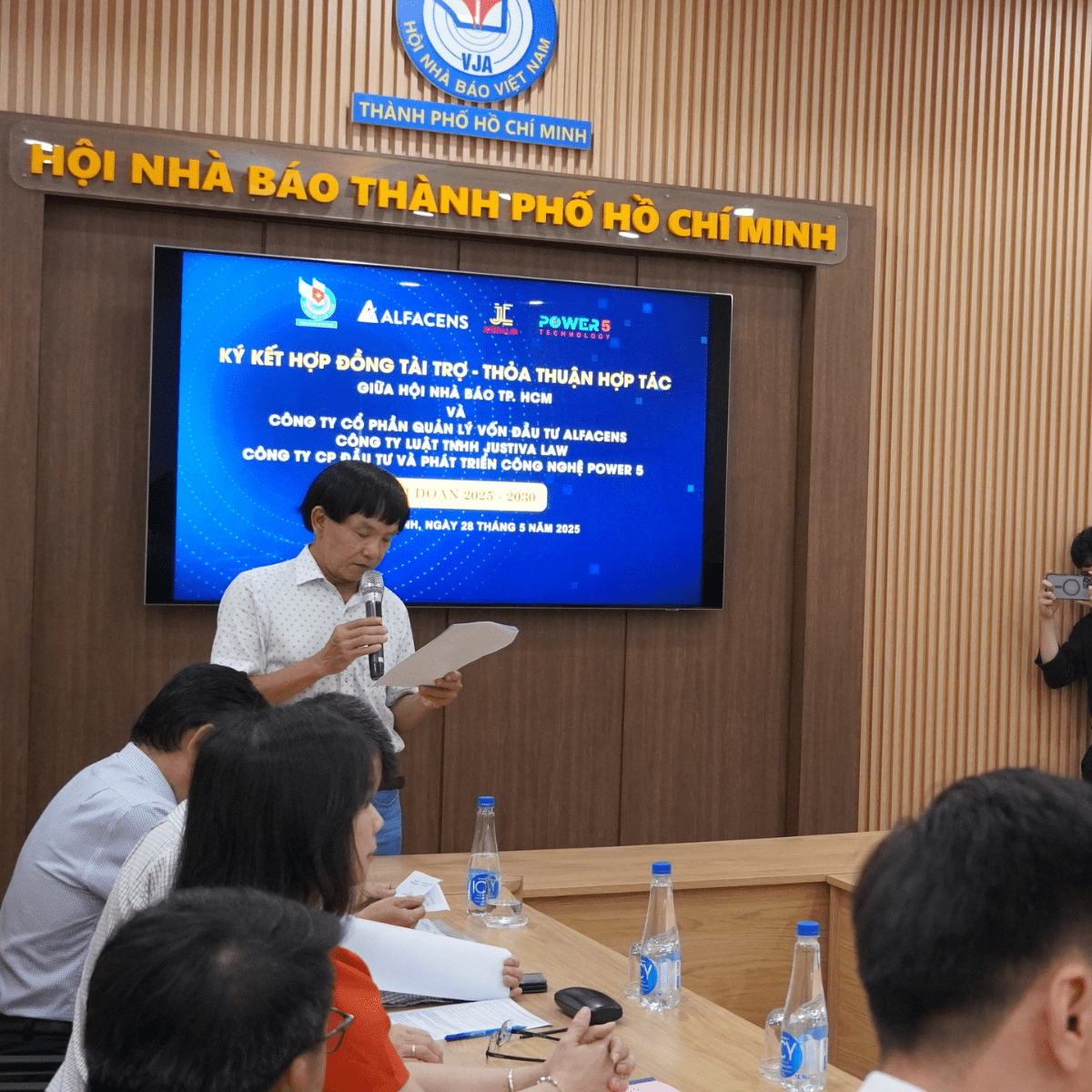

On May 28, 2025, Alfacens Capital officially signed a strategic sponsorship agreement with the Vietnam Journalists Association (VJA), marking a pivotal milestone in its long-term commitment to promoting ethical journalism, media integrity, and sustainable socio-cultural impact.

Media as a Vector of Societal Value, Not Just Information

At Alfacens, media is not simply a vehicle for brand storytelling — it is a transformative lever for shaping public discourse, enhancing civic consciousness, and amplifying purpose-driven narratives. This sponsorship reflects Alfacens’ strategic belief in the role of accountable, high-integrity journalism as a pillar of inclusive development and ecosystem resilience.

Vietnam Journalists Association – Core Institutional Partner for Press Development

Recognized as the premier professional body for Vietnam’s journalism community, the Vietnam Journalists Association (VJA) plays a central role in upholding journalistic standards, fostering ethical frameworks, and driving professional development across the media landscape. Through this partnership, Alfacens will help fund and co-develop initiatives including:

Capacity-building programs for reporters and editors

Digital transformation projects for modern journalism platforms aligned with industry 4.0 trends.

Alfacens – Investing in People, Knowledge, and Institutional Integrity

True to its mission of long-term, value-based investment, Alfacens Capital views strategic media engagement as a key component of sustainable development. Beyond financial capital, Alfacens is committed to enabling platforms, institutions, and individuals who uphold social responsibility, truth-based communication, and systemic transparency.

A Shared Commitment to Trustworthy, Constructive Media Ecosystems

The signing ceremony signifies more than a sponsorship — it represents a strategic convergence of missions: on one side, a capital partner dedicated to empowering purpose-led growth; on the other, a national institution representing the independent, credible, and socially responsive voice of journalism.

Alfacens Capital – Investing in the future by empowering the voice of truth.